If you’re looking for ways to invest your IRA, you might be wondering if combining gold IRA companies with crypto exchanges is a good idea.

While the correct investment will result in significant profits, a poor one might lead to enormous losses. The key is to do your research and understand your goals, time frame, and risk tolerance before making any decisions.

One option you might consider is Bitcoin IRA. Investing in cryptocurrencies such as Bitcoin and Ethereum through your retirement account is possible with this firm.

Before making any decisions, it’s important to understand how this works and whether or not it’s right for you.

Let’s take a closer look.

Bitcoin IRA Overview

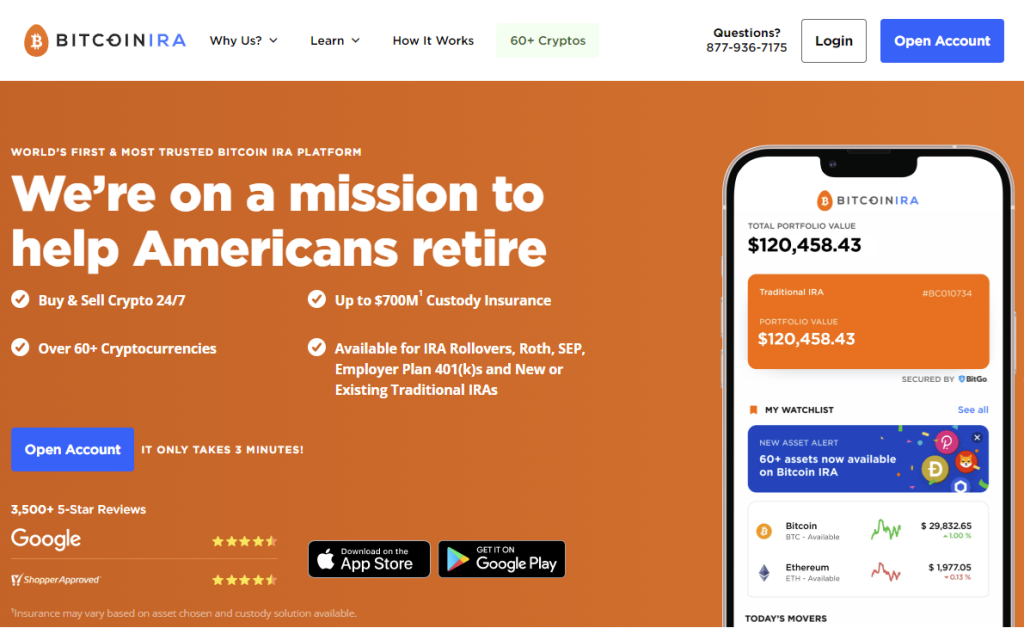

Bitcoin IRA is one of the leading companies in the space of cryptocurrency retirement accounts.

The company offers a secure space for protection and insurance of an individual’s assets, with a focus on cold storage.

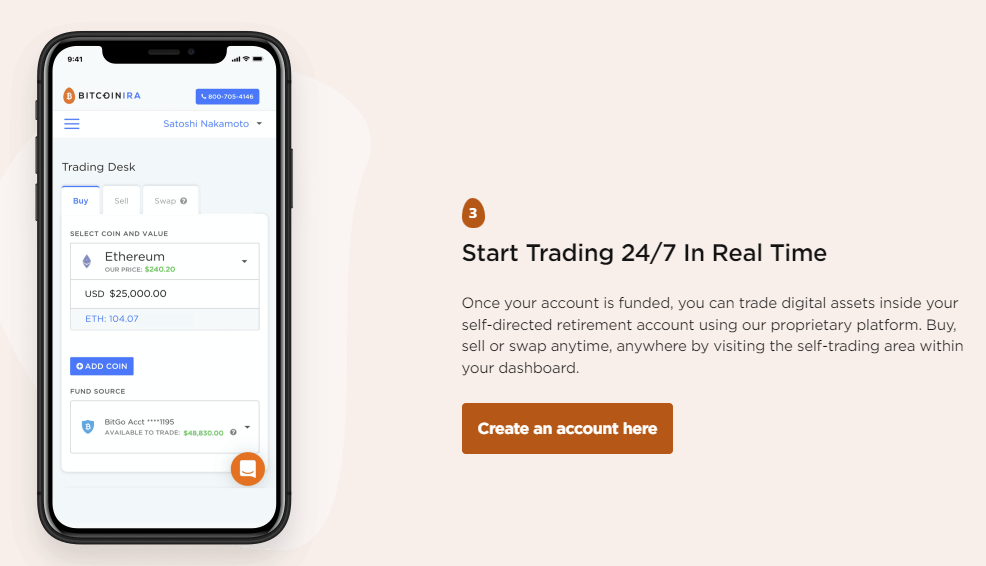

Bitcoin IRA is also available for trading around the clock daily so that customers can purchase and sell assets when the need arises.

With its commitment to security and customer service, it’s no wonder that since its inception in 2016, Bitcoin IRA has assisted thousands of customers in investing in cryptocurrencies like Bitcoin, Ethereum, Litecoin, and others.

If you’re looking for a reliable and user-friendly platform to help you invest in cryptocurrencies for your retirement, then Bitcoin IRA is worth considering.

The process of setting up a Bitcoin IRA is simple and only takes a few minutes.

Once you have funded your account, it usually takes five days for the funds to clear and you can start buying cryptocurrencies.

A factor to take into consideration is that Bitcoin IRA has a minimum balance requirement of $3,000 to start an account. This is usually not a deal-breaker as most retirement accounts have a larger starting amount.

An alternative to this is to start investing immediately with a $100 deposit to a saver IRA account and then make monthly deposits of $100. This is an option that Bitcoin IRA provides.

For those truly on a tight budget, consider the saver IRA account which allows you to start investing with only a $100 deposit.

Bitcoin IRA Benefits

There are several advantages to using Bitcoin IRA.

Crypto Investing Tax-Free

A self-directed IRA can be a great way to grow your wealth, as it allows you to defer or even avoid taxes on your gains.

This is particularly beneficial if you’re investing in something with significant potential for growth, such as crypto.

With a self-directed IRA, you’re in control of your own investment decisions, which gives you a lot of flexibility.

If you take your assets out of the plan before retirement, you may be charged a penalty, although this is not an issue for most individuals involved in crypto IRAs.

Cryptocurrencies are a relatively new asset class, and they’re still considered to be highly volatile.

However, many people believe that they have significant potential for long-term growth.

As such, investing in cryptocurrencies through a self-directed IRA can be a wise move for those looking to grow their wealth over the long term.

Low-Cost Gold Investing

When it comes to choosing a Bitcoin IRA, there are a few factors to consider.

One of the most important is the range of assets that the company offers. Many companies will provide stocks, bonds, ETFs, and even crypto assets like Bitcoin.

One must consider the security and protection that the company offers. You can invest confidently knowing that your money is safe and secure with top-notch security and protection.

Another factor to consider is the fees associated with buying and holding gold. Many traditional IRA companies charge high fees for buying and storing physical gold. However, with Bitcoin IRA, you can avoid these fees altogether.

Considering all of these factors, it’s clear that Bitcoin IRA is a great choice for those looking to also invest in alternative assets like gold!

Earn Interest

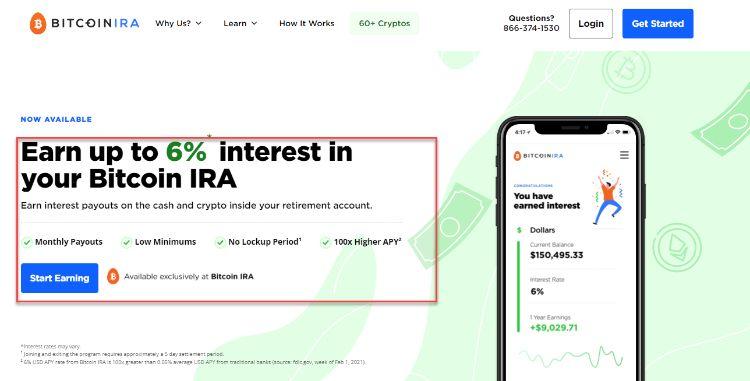

Investors looking to earn interest on their IRA account balances may be interested in Bitcoin IRA.

With this platform, investors can earn up to 6% APY on cash balances and 2% APY on Bitcoin and Ethereum balances.

The interest rate is only applicable if a few criteria are fulfilled. For the most part, this is worth it for most people.

Earned interest can build up to significant amounts given enough time, even if one did not start with a large initial investment.

Considering the volatility of the cryptocurrency market, the relatively stable interest rates offered by Bitcoin IRA may be appealing to some investors.

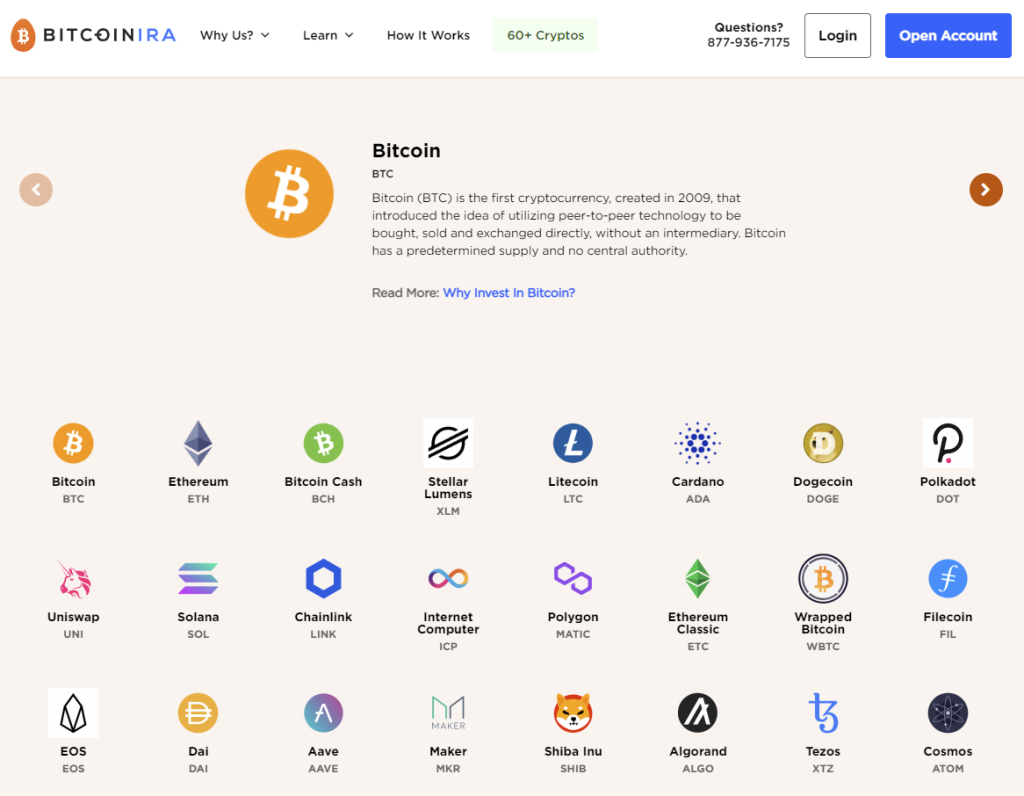

Diversity And Versatility

As anyone who has ever retired will tell you, it’s important to have a plan.

Gone are the days when you could rely on a single pension to support you through your retirement years. These days, it’s more important than ever to have multiple assets to draw from.

This is where Bitcoin IRA comes in. Bitcoin IRA offers investors the ability to invest in a wide variety of assets, including cryptocurrencies.

This gives you the benefits of both: crypto’s growth potential with IRA security and tax advantages.

Improvements Needed

Nothing is flawless, as with all items and services.

While I think that Bitcoin IRA is a fantastic alternative for individuals who wish to invest in cryptocurrencies, there are a few things that could be improved.

Bitcoin IRA Trading Fees

Before signing up with Bitcoin IRA, one should know about their fees.

There is a custodian fee, security fee, and one-time setup fee.

Don’t expect to find information about these fees on their website, you must contact Bitcoin IRA directly and get a quote.

The highlight, however, is your first investment and subsequent trades thereafter will incur no transaction fees.

It was also nice to find out that there are no recurring maintenance or monthly fees.

Cannot Transfer Crypto Directly Into IRA

If one is going to use a crypto IRA, it’s important to be aware of IRS regulations regarding cryptocurrency. Note that this is NOT specific to just Bitcoin IRA.

Cryptocurrencies cannot be transferred directly into an IRA; rather, they must first be converted to U.S. dollars via a cryptocurrency exchange, and then those dollars can be used to purchase assets within the IRA.

This is something to bear in mind for people who are unfamiliar with it since it might be tricky at first.

Low or Limited Liquidity

When deciding whether or not to invest in Bitcoin, it is important to consider how liquid your investment is.

While you can sell your Bitcoin and other cryptocurrencies at any moment, the value of these investments might be unpredictable, making this a little risky.

If you expect to cash out soon after making a profit, traditional IRA accounts might be a better option for you. More people currently use them, providing the liquidity (market) that one needs to sell into.

Aside from these charges and penalties, you may be required to pay fees and fines if you withdraw money from your IRA account before the expiration date.

Crypto Availability

If you’re an investor looking for a coin or token that isn’t currently offered on most trading platforms, it’s important to consider all of your options before making a decision.

While it may be difficult to find the exact coin you’re looking for, there are still plenty of other cryptocurrencies available that can provide you with the investment opportunities you’re looking for.

In addition, many trading platforms now offer gold as an investment option, which can provide a diversified portfolio and protect your assets against volatility.

How Bitcoin IRA Investing Works

A Bitcoin IRA is a wonderful method to get the advantages of both crypto and an IRA: growth potential, tax benefits, and security.

One can roll over a portion (or the whole) of an account that includes current IRA, 401(k), or 403(b) assets into USD and then use it to acquire BTC and other cryptos.

The process of converting to Bitcoin IRA begins with them rolling over your existing assets into its system and preparing everything in five days maximum to start trading cryptocurrency in your account.

This is a great way to invest in cryptocurrencies without having to worry about the volatility and security risks typically associated with them.

For many people, being able to carry out trades that they want, exchange assets, and be in control of the level of risk they’re willing to take makes this a compelling investment.

Bitcoin IRA Rollover Process

If you’re interested in carrying out the rollover to a Bitcoin IRA from your retirement account, there are a few process steps you’ll need to follow.

- First, create a BitcoinIRA account.

- Then, contact your current IRA institution and tell them you wish to roll over to a Bitcoin IRA.

- Bitcoin IRA will then move funds from your current provider into their own self-directed IRA that they created for you.

- Funds from the existing retirement account will be moved into the account holder’s bank account.

- Funds must be rolled into the new account within 60 days, this is the account holder’s responsibility.

- You can use those funds to buy crypto within the account via the BitcoinIRA platform.

Is Bitcoin IRA Safe?

Although there are many investment platforms to choose from, safety is always a key concern for investors.

No one wants to risk losing their hard-earned money to fraud or theft.

Fortunately, BitcoinIRA has several security measures in place to safeguard your account and digital currency investments.

Your digital assets are insured for up to $700 million, ensuring that if the platform is hacked or goes bankrupt, you will get your money back.

The custodian is BitGo Trust, which uses multi-signature technology and cold storage to ensure security.

Offline cryptocurrency storage, also known as cold storage, is the greatest way to keep your coins safe from attackers since they cannot be hacked if they are not connected to the internet.

Furthermore, all of your personal information is encrypted and kept on a server that is as secure as bank-level protection.

With these safety measures in place, you can rest assured that your investments are in good hands with BitcoinIRA.

Who Should Have a Bitcoin IRA?

Bitcoin IRA is perfect for individuals who want to diversify their portfolios by investing in crypto.

Bitcoin IRA is for individuals who can make their own investment decisions and are looking for tax-free growth in their assets.

It is for people who accept the volatility of the crypto market and have a long-term commitment and outlook towards this space.

Final Thoughts

When it comes to retirement planning, many people focus on traditional investment options like stocks and mutual funds.

However, with the recent surge in popularity of cryptocurrencies, more and more individuals are exploring the idea of investing in digital assets.

While nothing is bulletproof when it comes to investing, you can build a solid portfolio that can handle extreme swings by combining crypto trading on the blockchain with the stability of conventional investments like an IRA.

There are many different methods to trade cryptocurrencies on the blockchain, and each provides its own set of benefits and risks.

Be sure to consult with a financial advisor about investment choices that would align with the goals of your retirement portfolio.

Make sure to look into and understand the security features of your new account and make sure they fit your needs.

With digital assets still in their infancy and highly volatile, be sure you can handle the volatility.

By taking a holistic approach to retirement planning, you can give yourself the best chance possible for a bright future.

BitcoinIRA can be an excellent alternative for you if you are seeking long-term growth potential as well as the power to manage your investments.

Bitcoin IRA Review – FAQ

What Are Capital Gains Taxes?

The taxes you pay when you sell an asset that has appreciated, such as cryptocurrency, are called capital gains taxes.

Long-term capital gains (profits on assets held for more than a year) are taxed at a lower rate than short-term capital gains.

What Does An Insurance Policy Mean In Cryptocurrency?

An insurance policy is a type of financial protection that can help you protect yourself if an investment goes wrong.

An insurance policy may pay out if the value of your crypto investments drops, for example. If you invest in cryptocurrency and the value of your coins drops, you may be reimbursed for some or all of your losses with insurance coverage.

Finally, if the cryptocurrency exchange is hacked and your assets are stolen, an insurance policy will reimburse you for your losses.

What Are Alternative Investments?

An alternative investment is an asset that is not one of the conventional investment types, such as stocks, bonds, or cash.

Alternatives are often used to diversify a portfolio because they tend to have a low correlation with more traditional assets. They can include physical assets such as commodities and real estate, as well as investments in gold, real estate, private companies, hedge funds, and venture capital.

Bitcoin IRA, Sep IRA, and iTrustCapital are just a few alternatives to Bitcoin IRAs.